Inheritance and Gift Tax in Spain. In Spain each region has different tax rules and, therefore, inheriting or gifting property will have different tax implications depending on where the property is located. The truth is that those differences can be substantial and as you will see from this article, the tax amount varies depending on whether it is a lifetime gift or a transfer after death.

Quite often we come across clients who are valuing whether to gift their property in Spain to the children while they are alive rather than waiting to transfer it to them after death. In certain cases, this is because those clients are not using the property anymore, but the children are. In other cases, those clients think that this will save their beneficiaries from paying Inheritance Tax in Spain.

In this study, we are going to make a comparison between the different tax regimes that apply in some regions of Spain (called Autonomous Communities), focusing on those regions where the British (and foreigners in general) have been buying property more often: Andalusia, Balearic Islands, Canary Islands, Catalonia, Madrid and Valencia region.

We aim to show how much non-residents in Spain (in this case British but the information we provide in this article is valid for any other nationalities) must pay in taxes if they receive property after death or are recipients of a gift in Spain.

We will compare two cases for each tax using estate values of 180,000 Euro and 350,000 Euro respectively. It is important to note how different values affects tax. This is because inheritance and gift tax are calculated on a sliding scale that varies depending on the value of the assets as well as some other factors. The tax due is not a flat rate like in the UK (i.e. 40%) but based on a sliding scale.

The calculations will be based on the basis that the beneficiary is either the spouse (or civil partner) or a child over the age of 21 as they are treated in the same way for tax purposes.

INHERITANCE TAX:

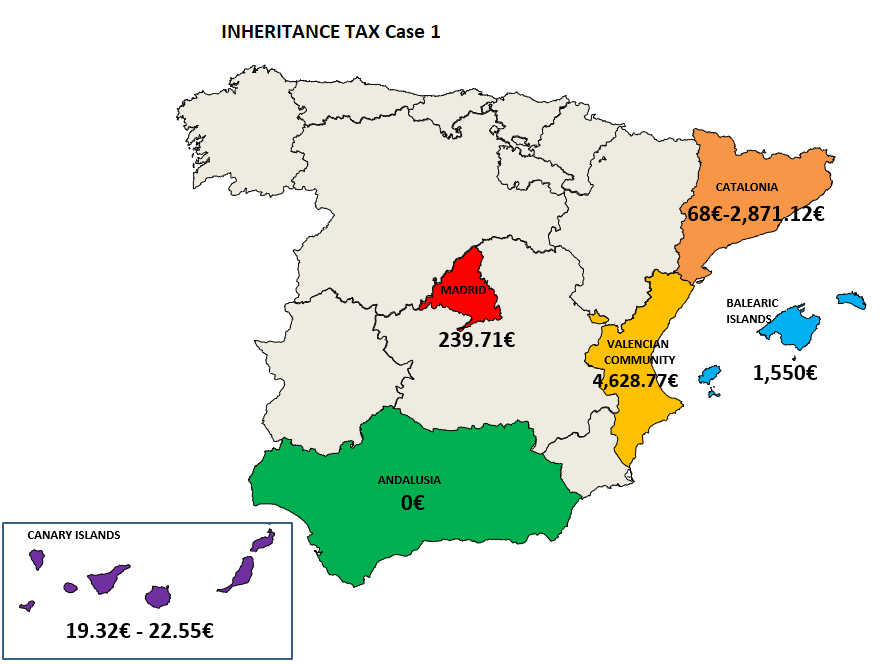

CASE SCENARIO 1: Mr. Joe Bloggs passed away with a Spanish estate worth 180,000€ that includes a property in Spain and a Spanish bank account. The beneficiary of his estate is Mrs. Bloggs, his wife. (Bear in mind that the tax due is usually the same if the beneficiaries are the children, except in the Canary Islands and Catalonia where we will point out some differences).

On the map below, you will see how those assets referred above are differently taxed. You might be surprised to see that the tax due can go from 0.00 Euro to 4,600 Euro, depending on where the assets are located.

For further detail, see below the different tax allowances and how this is calculated.

- ANDALUSIA

Current Tax allowance on the tax base of 1 million Euro.

Tax due: 0€

- BALEARIC ISLANDS

Current Tax allowance on the tax base of 25,000 Euro.

Tax due: 1,550€

- CANARY ISLANDS

Current Tax allowance on the tax base for the spouse/civil partner is 40,400 Euro and for the son/daughter is 23,125 Euro. In both cases, there is a tax allowance on the tax amount due of 99,9% if the amount is less than 55,000€.

Tax due by spouse/civil partner: 19.32€

Tax due by son/daughter: 22.55€

- CATALONIA

Current Tax allowance on the tax base of 100,000 Euro plus a tax allowance on the tax amount due of 99% for spouse/civil partner and 60% for children.

Tax due by spouse/civil partner: 68€

Tax due by son/daughter: 2,871.12€

- COMMUNITY OF MADRID

Current Tax allowance on the tax base of 16,000 Euro plus a tax allowance on the tax amount due of 99%.

Tax due: 239.71€

- VALENCIAN COMMUNITY

Current Tax allowance on the tax base of 100,000 Euro plus a tax allowance on the tax amount due of 50%.

Tax due: 4,628.77€

When it comes to an estate worth 350,000 Euro, the situation for the same case scenario, is as follows:

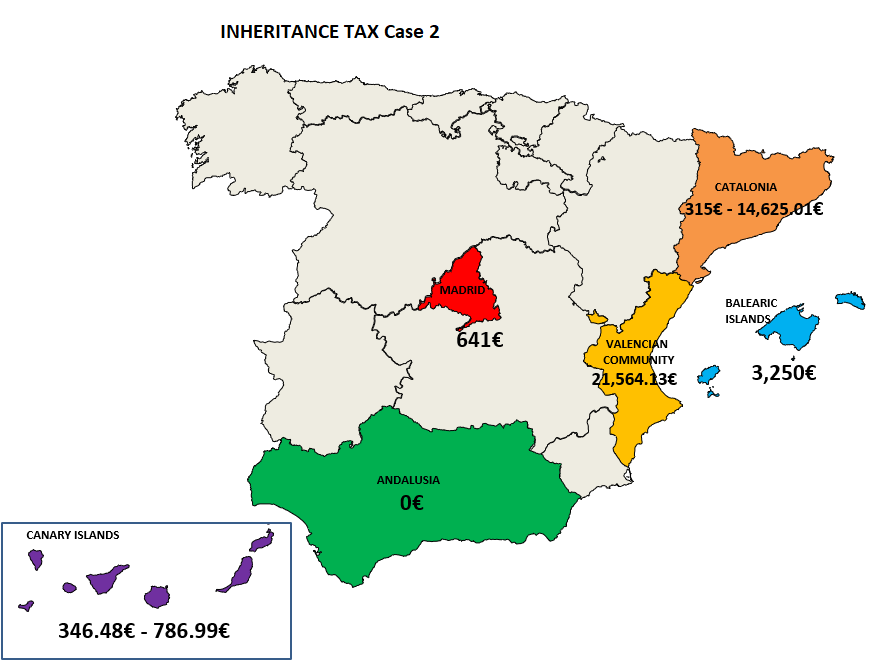

CASE SCENARIO 2: Mr. Joe Bloggs passed away being his Spanish estate worth 350,000€, including a property in Spain and a Spanish bank account. The beneficiary of his estate is Mrs. Bloggs, his wife. (Bear in mind that the tax due is usually the same if the beneficiary is his son or daughter, except in the Canary Islands and Catalonia where we point out the differences).

Let´s look again to the map.

How is this calculated?

*The tax allowances are the same that we have mentioned in CASE SCENARIO 1

- ANDALUSIA

Tax due: 0€

- BALEARIC ISLANDS

Tax due: 3,250€

- CANARY ISLANDS

Tax due by spouse/civil partner: 346.48€

Tax due by son/daughter: 786.99€

- CATALONIA

Tax due by spouse/civil partner: 315€

Tax due by son/daughter: 14,625.01€

- COMMUNITY OF MADRID

Tax due: 641€

- VALENCIAN COMMUNITY

Tax due: 21,564.13€

Once again, you might be surprised to see that on the same case scenario but with a larger estate, the tax rates and amounts due in those regions also vary.

Now, lets have a look to lifetime gifts:

GIFT TAX:

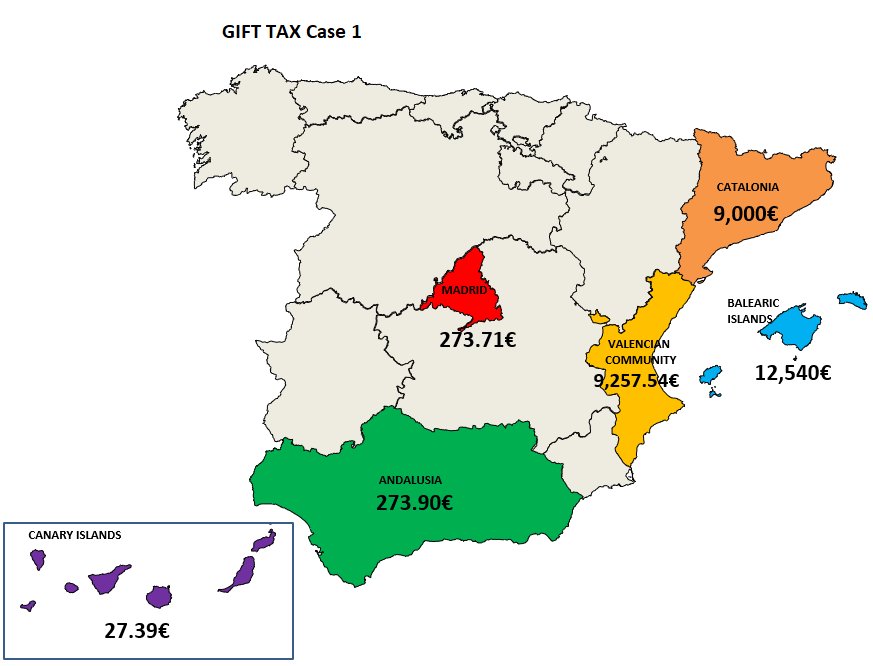

CASE SCENARIO 1: Mr. Joe Bloggs transfers by gift to his daughter or to his son his property in Spain worth 180,000€. (Bear in mind that the tax due is the same if the recipient is his wife/civil partner).

Let´s look at our map:

As you can see, one more time, the differences between regions are huge and the same case scenario in one region (same family, same assets) can be taxed more heavily by gift than by death (i.e. in Catalonia 0.00 Euro after death while 9.000 Euro by lifetime gift) while in some other regions there is not much of a difference between transferring property after death or by gift.

- ANDALUSIA

Tax allowance on the tax amount due of 99%.

Tax due: 273.90€

- BALEARIC ISLANDS

Tax allowance on the tax amount due depending on the tax base.

Tax due: 12,540€

- CANARY ISLANDS

Tax allowance on the tax amount due of 99% if the amount is less than 55,000€.

Tax due: 27.39€

- CATALONIA

Tax due: 9,000€

- COMMUNITY OF MADRID

Tax allowance on the tax amount due of 99%

Tax due: 273.71

- VALENCIAN COMMUNITY

Tax allowance on the tax base of 100,000 Euro if the recipient´s assets are below 600,000 Euro

Tax due: 9,257.54€

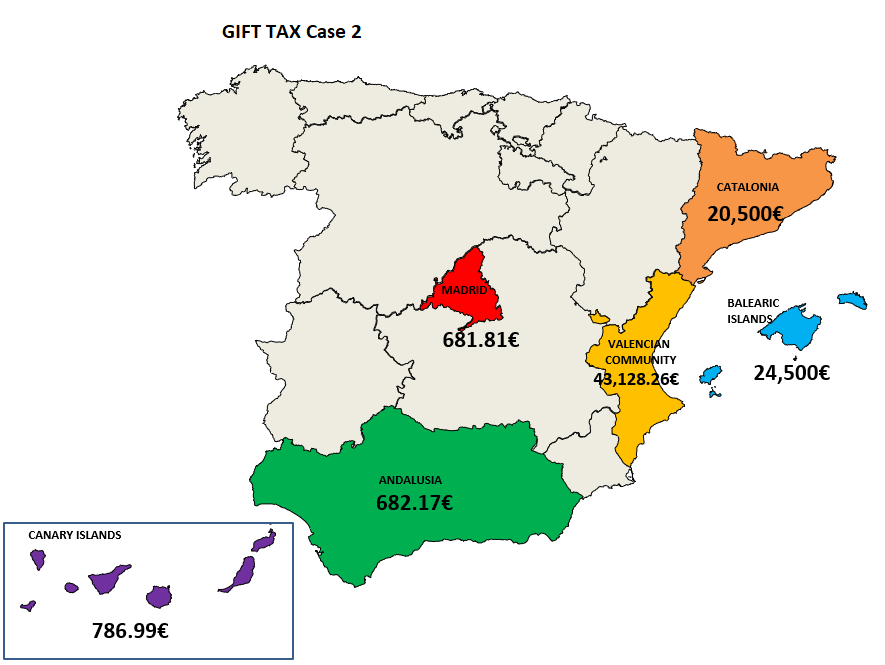

If we look at a greater value of the property that is going to be transferred, the amount of tax then increases exponentially.

CASE SCENARIO 2: Mr. Joe Bloggs transfers by gift to his daughter or son his second residence in Spain with a value of 350,000€. (Bear in mind that the tax due is the same if the recipient is his wife/civil partner).

*The tax allowances are the same that we have mentioned in CASE SCENARIO 1

- ANDALUSIA

Tax due: 682.17€

- BALEARIC ISLANDS

Tax due: 24,500€

- CANARY ISLANDS

Tax due: 786.99€

- CATALONIA

Tax due: 20,500€

- COMMUNITY OF MADRID

Tax due: 681.81€

- VALENCIAN COMMUNITY

Tax due: 43,128.26€

CONCLUSION: Taxes in Spain when transferring property might be extremely different across the Spanish territory. They vary depending on where the assets are located (or in the event of Spanish residents, where the beneficiary is a tax resident), their value, the kinship and how the property is transferred i.e. after death or by gift.

Transferring Spanish property to the children while the parents are alive can benefit the children saving them from dealing with the future estate and, therefore, prove the easiest option but it can also be much more taxable and not worth it. It is therefore paramount to study all the available options to ensure that a lifetime gift does not prove more expensive than leaving the asset on a Will. Your Spanish lawyer should be able to guide you on the best of way of transferring property in Spain to your loved ones.

Contact us for more information.

Spanish Lawyer